Focus your underwriters on high-ROI opportunities

Instantly evaluate properties against your guidelines, so underwriters can focus on the best opportunities instead of wasting time on deals that won't bind.

Instantly evaluate properties against your guidelines, so underwriters can focus on the best opportunities instead of wasting time on deals that won't bind.

70%

Less Time on Unwritable Risks

70%

Less Time on Unwritable Risks

Focus underwriters on what matters

Automate guideline checking, focus on profitable risks

Automate guideline checking, focus on profitable risks

Manual guideline checking bottlenecks

Hours wasted on unwritable risks

Hours wasted on unwritable risks

Hours wasted on unwritable risks

Inconsistent guideline application

Inconsistent guideline application

Inconsistent guideline application

Miss profitable deals that fit appetite

Miss profitable deals that fit appetite

Miss profitable deals that fit appetite

Rigid risk selection

Rigid risk selection

Rigid risk selection

Slow response to market changes

Slow response to market changes

Slow response to market changes

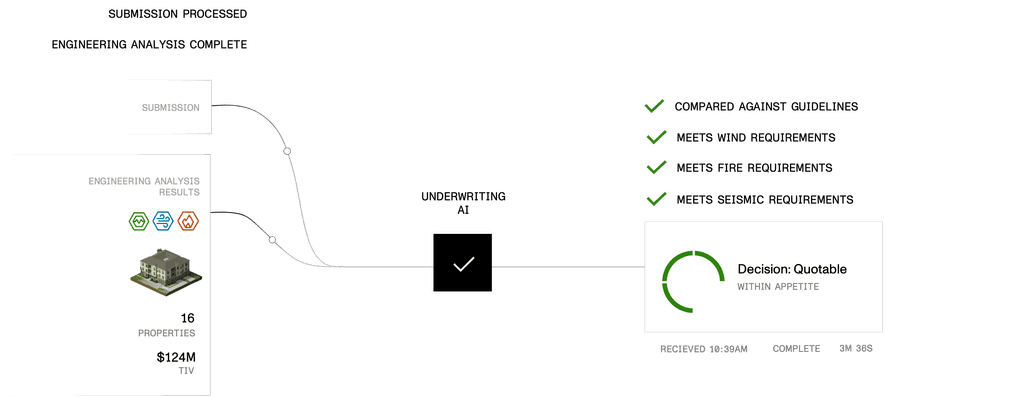

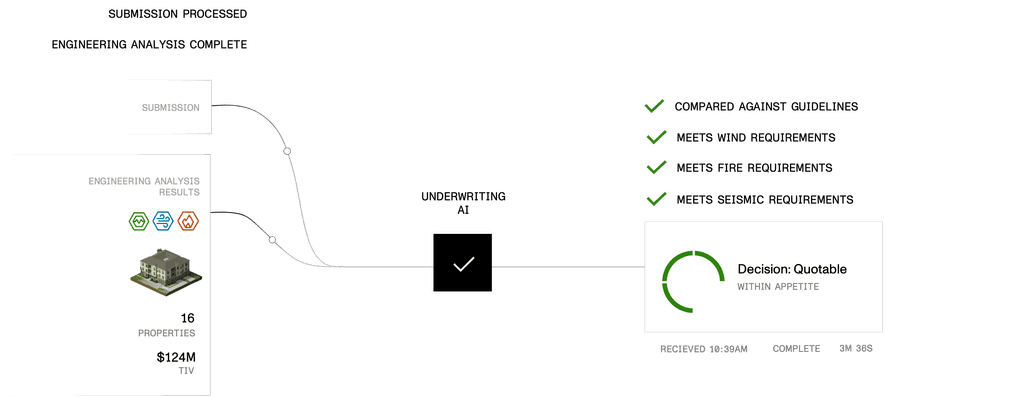

Automated risk screening and proactive loss control

Instant guideline checking for rapid triage

Instant guideline checking for rapid triage

Instant guideline checking for rapid triage

Consistent risk selection, every time

Consistent risk selection, every time

Consistent risk selection, every time

Flag best opportunities first

Flag best opportunities first

Flag best opportunities first

Convert declines into conditional approvals

Convert declines into conditional approvals

Convert declines into conditional approvals

Quick market response

Quick market response

Quick market response

Underwriting AI capabilities

We built the property underwriting assistant carriers always wanted

Complete guideline screening automation

Instant checking against your exact criteria

Complete guideline screening automation

Instant checking against your exact criteria

Complete guideline screening automation

Instant checking against your exact criteria

Lightning quick decisions

Strengthen negotiations with validated building data

Lightning quick decisions

Strengthen negotiations with validated building data

Lightning quick decisions

Strengthen negotiations with validated building data

Focus attention on bindable business

Catch critical issues before they become losses

Focus attention on bindable business

Catch critical issues before they become losses

Focus attention on bindable business

Catch critical issues before they become losses

Stay within risk appetite automatically

Control accumulation using vetted data and resilience interventions

Stay within risk appetite automatically

Control accumulation using vetted data and resilience interventions

Stay within risk appetite automatically

Control accumulation using vetted data and resilience interventions

ResiQuant supports a growing number of integrations

Learn more about the many tools ResiQuant supports out of the box, and via API.

Explore other AI capabilities

Explore other AI capabilities

See how our specialized AI agents work together to transform property underwriting.

See how our specialized AI agents work together to transform property underwriting.

Submissions

Submissions

Submissions

Engineering intelligence

Engineering intelligence